The following is a basic guide to help you learn about corporations, specifically about business corporations. The corporation is the traditional business for growth and large-scale companies. It is also the most rigid and formal business organization, with many rules and annual rituals to follow.

Who Owns a Corporation

A corporation is a legal entity owned by shareholders but completely separate from them. This means that the corporation itself, not the shareholders that own it, is held legally liable for the actions and debts incurred by the business. It also means that shareholders have no direct rights to the money or any other assets of the corporation. If the directors choose to give the shareholders dividends, that’s great. Otherwise, shareholders get nothing from the corporation until they sell their shares.

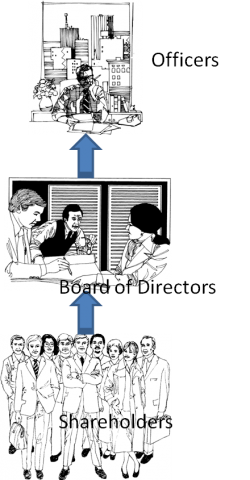

Who Manages a Corporation

The shareholders elect one or more people to serve on the board of directors. In turn, the Board of Directors exists to govern the corporation and set its policies and priorities, approve major business decisions, and appoint officers. The officers hold titles such as president, secretary and treasurer, and are the only ones with authority to sign contracts and to run the corporation on a day to day basis.

How Do Corporations Work

Corporations are more structured than other business types, in that there are a number of formalities that must be followed. Companies that are positioned for growth and seeking outside investment generally prefer to use corporations. In order to attract this outside investment, corporations often end up with more costly administrative fees and complex tax and legal requirements. For a small business looking for liability protection without the formalities of incorporation, using a limited liability companies (LLCs) instead is often the better choice.

Corporations offer the ability to sell ownership shares in the business through stock offerings. “Going public” through an initial public offering (IPO) is a major selling point in attracting investment capital and high quality employees. Corporations also have the ability to issue stock options as a way to recruit and reward management, staff and investors.For any state (outside of the state where they are incorporated) where the corporation is doing business, the corporation will likely have to register to do business with the Secretary of State and pay taxes in that state. For example, a corporation incorporated in Delaware but doing business in New York will have to file an Application for Authority to do business in New York, register with the NYS Department of Taxation and Finance, and collect New York State sales tax for any sales to consumers in the state.

Glossary of Terms Related to Business Corporations

- Corporation: A legal entity owned by shareholders, separate from its owners, and offering limited liability protection. Commonly used for growth-oriented and large-scale companies.

- Shareholders: Individuals or entities that own shares in a corporation, granting them partial ownership and specific rights, such as voting on corporate matters.

- Legal Liability: The legal responsibility of a person or entity for the actions and debts incurred by a business.

- Dividends: Payments made by a corporation to its shareholders, usually as a distribution of profits.

- Board of Directors: A group of individuals elected by shareholders to govern a corporation, set policies and priorities, approve major business decisions, and appoint officers.

- Officers: High-ranking corporate executives with specific titles (e.g., president, secretary, treasurer) who are responsible for managing the corporation’s day-to-day operations and signing contracts.

- Limited Liability Company (LLC): A hybrid business structure that offers limited liability protection like a corporation but with simpler tax and legal requirements, often used by small businesses.

- Stock Offerings: The sale of ownership shares in a corporation to raise funds or attract investors.

- Initial Public Offering (IPO): The process of offering shares in a corporation to the public for the first time, typically to raise capital and attract high-quality employees.

- Stock Options: Contracts that give the holder the right, but not the obligation, to buy or sell shares of a corporation at a specific price within a certain period.

- Secretary of State: The government official responsible for overseeing business registrations and filings in each U.S. state. The actual title of the office varies from state to state.

- Application for Authority: A document required for a corporation incorporated in one state to register and conduct business in another state.

- State Department of Taxation and Finance: The government agency responsible for administering and enforcing tax laws and regulations in a given state. The actual name of this agency varies from state to state.

- Sales Tax: A tax imposed on the sale of goods and services, usually collected by the seller and paid to the state government. Although on the surface, sales tax and value-added tax (VAT) look similar, they are very different in how they work. There is no VAT in the United States.

- Doing Business: Engaging in commercial activities or transactions, such as selling products or services, in a specific state or jurisdiction.

- Formalities: The required procedures, rules, and practices that must be followed when operating a specific type of business, such as a corporation.

- Liability Protection: The limitation of an owner’s financial responsibility for the debts and actions of a business, typically provided by certain business structures like corporations and LLCs.